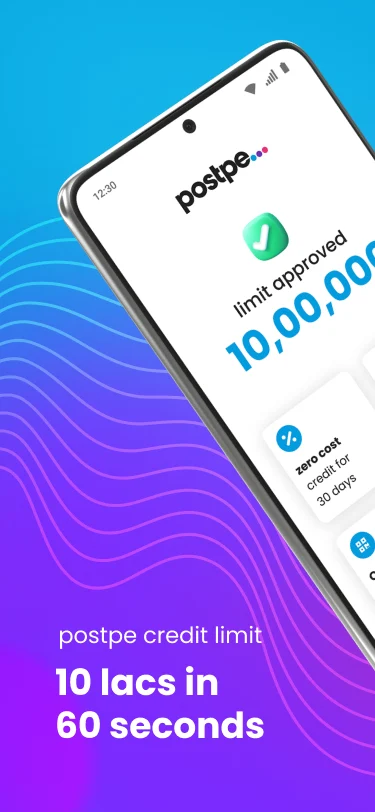

postpe - shop now pay later

Version: 1.4.8

By: BHARATPE

Size: 14.00 MB

Release Date: 29 Dec 2023

Download APK How to Install APK Filepostpe offers you the flexibility to access up to 10 lakhs in just 60 seconds, empowering you to live life to the fullest. With Postpe, enjoy 30 days of interest-free credit, scan and pay seamlessly using BharatPe QR codes, and access instant cash loans of up to 3 lakhs with Postpe cash. Don't pay now, postpe

**postpe - Shop Now, Pay Later: Frequently Asked Questions (FAQs)**

**1. What is postpe and how does it work?**

postpe is an app that offers users the flexibility to shop now and pay later. With postpe, you can access credit limits of up to 10 lakhs in just 60 seconds, enjoy 30 days of interest-free credit, and scan and pay at all BharatPe QRs. Additionally, you can avail instant cash loans of up to 3 lakhs with postpe cash.

**2. How do I use postpe?**

Using postpe is simple:

- Download the postpe app.

- Sign up using your phone number.

- Complete your KYC (Know Your Customer) process.

- Start transacting with postpe.

**3. When do I need to repay my dues?**

Bills are generated on the 1st of every month, and you have 5 days from bill generation to repay or convert to EMIs (Equated Monthly Installments). You can repay your bill using any UPI app, debit card, or net banking.

**4. What are the EMI calculation and repayment terms?**

- postpe extends credit lines ranging from Rs. 1,000 to Rs. 10,00,000 with instant approval and no collateral for a tenure of up to 15 months.

- Users have the option to convert bills to EMIs ranging from 3 months to 15 months. You can also repay the bill in full at no interest cost by the due date.

**5. What is the Annual Percentage Rate (APR) for postpe loans?**

The APR for postpe loans ranges from 18% to 70%. The specific rate is communicated on the postpe app when converting bills to EMIs or applying for postpe loans. The APR varies for different EMI tenures.

**6. Can you provide an example of postpe cash and Bill to EMI conversion?**

Sure:

- Example of postpe cash: For a user choosing Rs. 1,00,000 for a tenure of 12 months at an interest rate of 18% per year (reducing), the total repayment amount would be Rs. 1,11,196.

- Example of Bill to EMI conversion: For an amount of Rs. 1,00,000 converted into EMI for 6 months at an interest rate of 18% per year, the total repayment amount would be Rs. 1,09,000.

**7. What permissions does postpe require?**

postpe requires SIM binding (Send and Receive SMS) as per NPCI regulations for authentication and authorization of payments. Additionally, permissions like Location/Device Information and Contacts are necessary to provide better underwriting for loan offers.

**8. Who are the NBFC partners of postpe?**

postpe has partnered with RBI-approved NBFCs including LendenClub, TrillionLoans Fintech Pvt Ltd, and Liquiloans. The postpe credit limit is sanctioned by one of the listed NBFCs, and users will be shown a sanction letter within the app for transparency.

**9. How can I contact postpe for queries and suggestions?**

You can reach out to us at:

- Email: help@postpe.app

- Website: postpe.app

- Address: 7th Floor, Tower 8C, Cyber City, DLF City Phase 2, Gurugram, Haryana, 122008

For further assistance, feel free to explore our app or contact us directly.

Popular Apps

New Apps

Latest Apps

Total Reviews: 1

5 ★

4 ★

3 ★

2 ★

1 ★

Top Apps

-

.webp) Endel: Focus, Relax ⭐ 4.7

Endel: Focus, Relax ⭐ 4.7 -

.webp) Zen: Relax, Meditate ⭐ 3.7

Zen: Relax, Meditate ⭐ 3.7 -

.webp) Accupedo Pedometer ⭐ 4.4

Accupedo Pedometer ⭐ 4.4 -

.webp) Doodle Art: Magic Drawing App ⭐ 4.1

Doodle Art: Magic Drawing App ⭐ 4.1 -

.webp) Word Cloud ⭐ 4.1

Word Cloud ⭐ 4.1 -

.webp) PeakFinder ⭐ 4.3

PeakFinder ⭐ 4.3 -

.webp) Pass2U Wallet - Add store card ⭐ 4.0

Pass2U Wallet - Add store card ⭐ 4.0 -

.webp) Travel Tracker - GPS tracker ⭐ 3.8

Travel Tracker - GPS tracker ⭐ 3.8 -

.webp) OruxMaps GP ⭐ 4.0

OruxMaps GP ⭐ 4.0 -

.webp) PeakVisor - 3D Maps & Peaks Id ⭐ 3.9

PeakVisor - 3D Maps & Peaks Id ⭐ 3.9 -

.webp) Planes Live - Flight Tracker ⭐ 4.3

Planes Live - Flight Tracker ⭐ 4.3

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)