mPokket: Instant Loan App

Version: 3.9.2

By: MAYBRIGHT VENTURES PRIVATE LIMITED

Size: 54.00 MB

Release Date: 27 Mar 2024

Download APK How to Install APK FileBrand Name : MAYBRIGHT VENTURES PRIVATE LIMITED

Developer : Maybright Ventures Private Limited

App Size : 54.00 MB

Version : 3.9.2

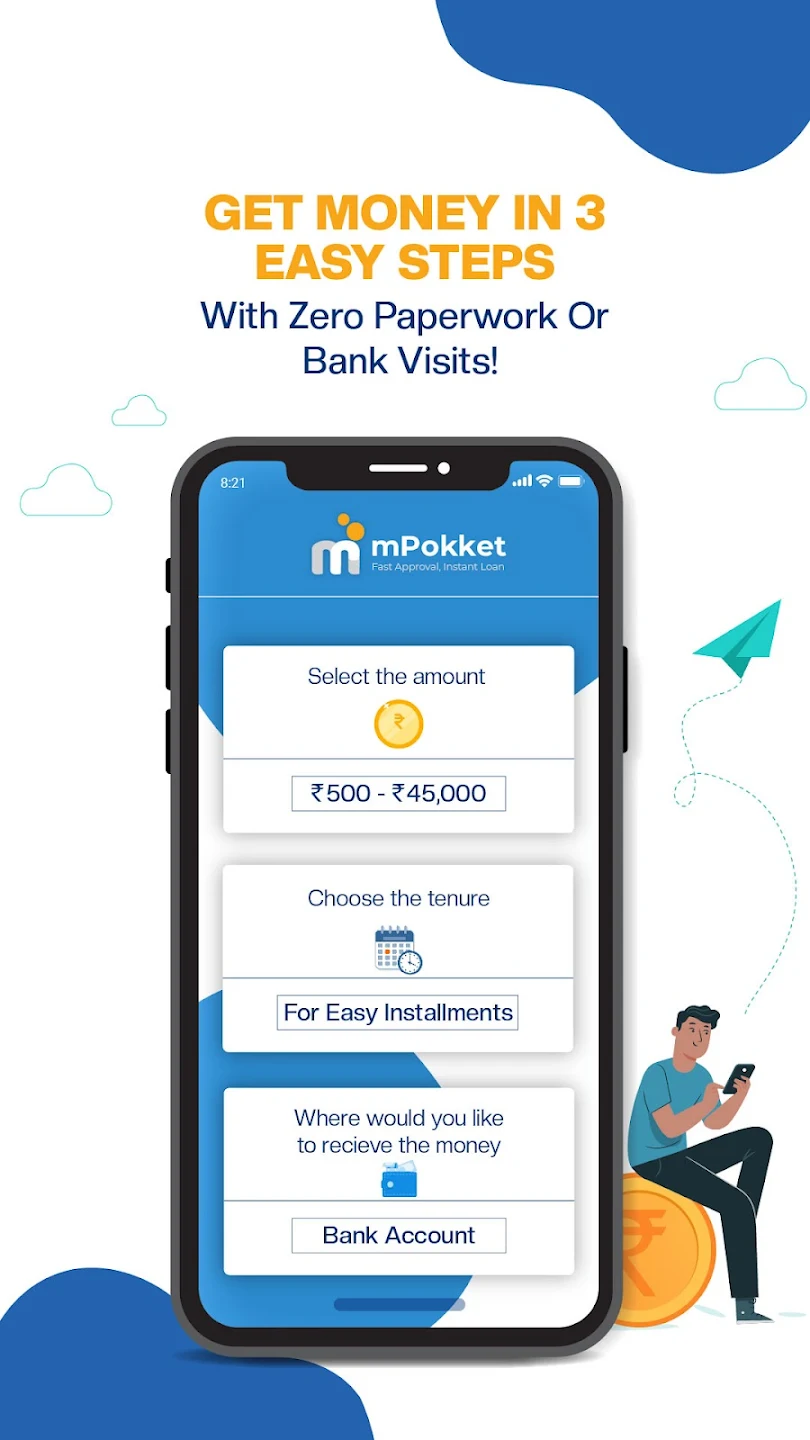

In need of quick cash? Look no further than mPokket, the ultimate solution for instant personal loans up to ₹45,000. With over 3.5 crore satisfied users, mPokket is the go-to instant loan app for both salaried professionals and students across India. What sets mPokket apart is its seamless digital loan processing, ensuring a secure and hassle-free borrowing experience.

**Frequently Asked Questions (FAQ) about mPokket Instant Loan App**

**1. What is mPokket?**

- mPokket is an instant loan app that provides personal loans up to ₹45,000 within minutes. It caters to both salaried professionals and students, offering a seamless and secure borrowing experience.

**2. What loan amount can I expect from mPokket?**

- You can avail of loans up to ₹45,000 through the mPokket app, making it a convenient option for various financial needs.

**3. What are the interest rates offered by mPokket?**

- Interest rates for loans through mPokket range from 0% to 4% per month, ensuring affordable borrowing options for users.

**4. What is the tenure for repayment of loans from mPokket?**

- You can choose a repayment tenure ranging from 61 days to 1 year, providing flexibility in managing your loan repayments.

**5. How quickly can I get a loan approved with mPokket?**

- With minimal documentation and a streamlined process, mPokket offers instant loan approvals, with funds credited directly to your bank account in just 10 minutes.

**6. Who is eligible to apply for a loan through mPokket?**

- Both salaried professionals and students across India are eligible to apply for instant loans through the mPokket app. Applicants must be above 18 years of age with valid Aadhaar and PAN Card.

**7. What documents are required to apply for a loan via mPokket?**

- To avail of an instant personal loan, you need to submit documents such as an Aadhaar Card, PAN Card, College ID card (for students), last 3 months bank statement, Salary Slip/Joining Letter, Company/Business details.

**8. Is mPokket a secure platform for loan transactions?**

- Yes, mPokket ensures 100% digital loan processing, prioritizing the security and confidentiality of user information. The app is trusted by over 3.5 crore Indians and complies with regulatory standards.

**9. What are the key features of the mPokket app?**

- The mPokket app offers features like instant personal loans, cash transfers to bank accounts, flexible repayment options, rewards for timely repayments, and a transparent fee structure.

**10. How can I contact mPokket for support or queries?**

- For assistance, you can email the mPokket support team at support@mpokket.com. Additionally, you can visit the official website at www.mpokket.in for further information or to get in touch with customer service.

Popular Apps

New Apps

Latest Apps

Total Reviews: 1

5 ★

4 ★

3 ★

2 ★

1 ★

Top Apps

-

.webp) Endel: Focus, Relax ⭐ 4.7

Endel: Focus, Relax ⭐ 4.7 -

.webp) Zen: Relax, Meditate ⭐ 3.7

Zen: Relax, Meditate ⭐ 3.7 -

.webp) Accupedo Pedometer ⭐ 4.4

Accupedo Pedometer ⭐ 4.4 -

.webp) Doodle Art: Magic Drawing App ⭐ 4.1

Doodle Art: Magic Drawing App ⭐ 4.1 -

.webp) Word Cloud ⭐ 4.1

Word Cloud ⭐ 4.1 -

.webp) PeakFinder ⭐ 4.3

PeakFinder ⭐ 4.3 -

.webp) Pass2U Wallet - Add store card ⭐ 4.0

Pass2U Wallet - Add store card ⭐ 4.0 -

.webp) Travel Tracker - GPS tracker ⭐ 3.8

Travel Tracker - GPS tracker ⭐ 3.8 -

.webp) OruxMaps GP ⭐ 4.0

OruxMaps GP ⭐ 4.0 -

.webp) PeakVisor - 3D Maps & Peaks Id ⭐ 3.9

PeakVisor - 3D Maps & Peaks Id ⭐ 3.9 -

.webp) Planes Live - Flight Tracker ⭐ 4.3

Planes Live - Flight Tracker ⭐ 4.3

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)